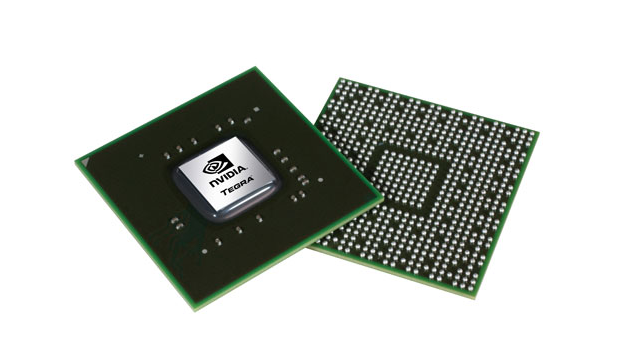

After 5 years of effort, Nvidia looks to be abandoning its efforts to move into mobile chipset manufacturing for smartphones and tablets and will instead focus on chipset development for gaming devices, according to the Wall Street Journal. Nvidia initially began to focus on mobile phones and tablets in 2009 as Android itself was picking up steam, with many early Android OEMs such as LG and Archos signing on to develop and launch devices with the first generations of its Tegra chipset, LG with the Optimus 2x and Archos with its tablets.

After 5 years of effort, Nvidia looks to be abandoning its efforts to move into mobile chipset manufacturing for smartphones and tablets and will instead focus on chipset development for gaming devices, according to the Wall Street Journal. Nvidia initially began to focus on mobile phones and tablets in 2009 as Android itself was picking up steam, with many early Android OEMs such as LG and Archos signing on to develop and launch devices with the first generations of its Tegra chipset, LG with the Optimus 2x and Archos with its tablets.

However, Nvidia is slowly moving away from making any major announcements regarding mobile phones after the announcement of the Tegra 4i chipset with LTE last year that featured an integrated baseband after years of chipsets that required separate chipsets for cellular radios and wireless radios.

This wasn’t enough to attract major OEMs again, while facing stiff competition from Qualcomm and MediaTek. This also follows the lukewarm reception of the K1 chipset meant for tablets and embedded hardwaew that has still yet to make an appearance in any retail hardware after being announced this year, with new reports that it might be repurposed as a low-power chipset for servers.

As few if any major Android OEMs decided to implement current Tegra chipsets outside of local Chinese manufacturers such as Xiaomi and France’s Wiko, recent statements made by CEO Jen-Hsun Huang during its earnings call last week signal a retreat from the tanking profit margins of the mobile phone sector and an increased focus on Android gaming products, such as its own Shield portable console, which has received critical praise in recent months after being initially received as a novelty when released last year owing to its high price and lack of notable titles.

With Nvidia continuing to support the Shield months after it was expected to be abandoned with new titles and updates, the company’s retreat from mobile phones and tablets back to gaming may save its chipset business, as the margins in tablets and mobile phones are collapsing thanks to Google’s Nexus initiative as well as companies such as OnePlus and the aforementioned Xiaomi begin a worldwide push on the premise of flagship performance for midrange pricing without cutting corners on key components such as chipsets and displays for up to half the cost of the major Android OEMs by selling unlocked devices direct to customers.